In case you have missed it, two days ago The Atlanta Journal-Constitution has published an interesting piece on Amazon and Georgia affiliate nexus tax. Here’s an excerpt from it:

Georgia shoppers at Amazon still aren’t paying sales tax, three weeks after the start of a state law designed to snag the money from the world’s biggest online retailer.

Shoppers buying items from Amazon.com to be shipped to Georgia should be prompted to pay sales tax under the law that took effect Jan. 1. But repeated checks of Amazon.com show that isn’t happening. [more in their Amazon fails to collect new Georgia tax article]

What exactly is AJC referring to? Well, there are nine states which have enacted  the so-called “affiliate nexus tax” (or “Amazon tax”, as some call them) laws. Each state has its own requirements for merchants/advertisers, but a general rule of thumb is that out-of-state merchants/advertisers who in any given year exceed $10,000 sales threshold to customers residing in the tax law state in sales which have been referred through affiliates residing in the same state (e.g.: orders by New York state residents driven to the merchant by their NY-based affiliates) are subject to a sales tax [more in this article by a San José State University-based CPA].

the so-called “affiliate nexus tax” (or “Amazon tax”, as some call them) laws. Each state has its own requirements for merchants/advertisers, but a general rule of thumb is that out-of-state merchants/advertisers who in any given year exceed $10,000 sales threshold to customers residing in the tax law state in sales which have been referred through affiliates residing in the same state (e.g.: orders by New York state residents driven to the merchant by their NY-based affiliates) are subject to a sales tax [more in this article by a San José State University-based CPA].

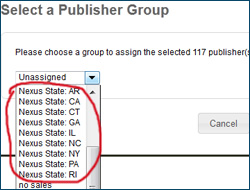

These 9 states are:

- Arkansas (law passed in 2011)

- California (went into effect Sep 15, 2012 | work-around available)

- Connecticut (passed in 2011)

- Georgia (went into effect in July 2012)

- Illinois (passed in 2011)

- New York (passed in 2008)

- North Carolina (passed in 2009)

- Pennsylvania (reinstated Sep 1, 2012 | work-around available)

- Rhode Island (passed in 2009)

If you run an affiliate program, and have affiliates in these states referring sales to you, keep an eye on the volume of sales to state residents, or, better yet, collect the respective sales tax when sales are made to residents of these states — to be able to pay your state-specific sales taxes when they are due.

Geno,

Thank you for pointing this out. The reasons why Amazon is not collecting in Georgia and not terminating their affiliates is still unknown, but there’s speculation they’re launching litigation. This would definitely NOT apply to other out-of-state retailers. Retailers should either collect sales tax for the states where these laws have passed, comply with work-arounds available in NY, CA and PA, or terminate their affiliate relationships – to avoid penalties and fines. And they should most definitely consult professional legal and tax advice (of which this is NOT – i’m just an involved advocate, not a lawyer or tax professional).

My organization, the Performance Marketing Association, has been fighting these unconstitutional state laws for over 4 years now, through our grassroots efforts and our own litigation (we won our suit against Illinois, we are now in an appeal). More information can be found at http://www.performancemarketingassociation.com.

Rebecca Madigan

Executive Director

Performance Marketing Association

Great input! Thank you for chiming in with it, Rebecca.

Pingback: Marketing Day: January 28, 2013

Please help me with a clarification on this one: from what I understand, only merchants / advertisers that have a physical presence in the US are required to collect this sales tax. Does this tax affect merchants / advertisers outside the US – from EU, for example, but with an office in the US?

Should they begin collecting the sales tax from affiliates generating sales in the 9 states that have passed the nexus law?

Cristian,

Sales tax is collected from consumers, not from affiliates. Whether or not you must collect sales tax from your US consumers, based on where your office is located in the US and where you have affiliates, is a question you must ask an attorney. I highly recommend you seek legal advice.

Thank you, Rebecca.

I’ll get back on this subject with an update to share after I consult with our legal dept.

Nexus is already confusing… this just makes it downright complicated. Luckily, I don’t sell physical goods and don’t have salespeople “on the ground” in other states etc.