IBM Coremetrics has just added Cyber Monday 2011 data to their benchmark report I blogged about yesterday.

Here are the things that have caught my eye:

Cyber Monday 2011 — 5 Noteworthy Facts

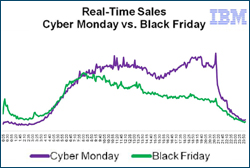

Overall spending increase — Online sales were up 33% over 2010, 29.3% up over Black Friday 2011, and AOV (avergage order value) also went up from $193.24 to $198.26

Overall spending increase — Online sales were up 33% over 2010, 29.3% up over Black Friday 2011, and AOV (avergage order value) also went up from $193.24 to $198.26- Conversion rate — Overall conversion rate went up from 5.6% in 2010 to 5.71%, mobile seeing the best improvement (from 2.24% to 2.99%)

- Mobile sales growth — Nearly 11% of people used a mobile device to visit e-tailers’ websites (up from some 4% last year), resulting in a nearly threefold growth in mobile sales (6.6% in 2011 vs 2.3% in 2010)

- Social media part — While “discussions leading up to Cyber Monday increased in volume by 115% compared to 2010”, resuling in 0.93% of site traffic, only 0.56% of Cyber Monday shoppers were referred directly from social networks.

- Facebook vs Twitter — Facebook referral traffic accounted for 0.8% of all e-tailers’ Cyber Monday traffic (up from 0.73% in 2010), while Twitter referred only 0.02% (down from 0.07% in 2010)

Important: All of the above reflects U.S. data.

To see what people have been buying (good data both for affiliates, and for merchants to review), especially in electronics — a niche that registered the highest growth – 26% over 2010 — see these lists by Larry Magid.

Make sure you also download IBM’s full 10-page Cyber Monday Report 2011 here [PDF file], which among other things also contains detailed information and 2011-vs-2010 comparisons of sales data in such categories as Apparel (one of the best in one-page bounce rates – 25.5%), Department Stores (champion in average session length – 8:18), Health and Beauty (best in conversion – 5.4%), and Home Goods (best 2011-over-2010 improvement – 68.4%, and largest AOV – $290.11).

Yesterday night Sam Harrelson has put together this quick (but thought-provoking) post on Twitter-referred traffic: Why Twitter Drove More Trafffic on Cyber Monday Than You Think.

Another valid point was raised by Betty Hakes, who wonders what exactly drove the mobile shopping. There are mobile social apps, and emails, and other cross-channel involvements that couldn’t be painted one color, but are closely intertwined (say, social + mobile, or email + mobile, as in her examples).

All very good points!

Pingback: How To Get Paid To Buy Christmas Gifts – Jayzilla